Hello, everyone! Welcome back to our site. Personal loans are important in every individual’s life. If you are a salaried person, you can easily get a personal loan from any bank, finance company, or NBFC. At the same time, if you are self-employed, it can be more difficult to obtain a personal loan. If you are getting a personal loan with high interest rates, fees, and charges, this page is here to help you. You will find the three best personal loan applications available online. These applications can provide a high loan amount with a low interest rate, along with multiple repayment tenures.

Credit Saison India – Loan APP ( APPLY HERE )

In this list, the first application we see is Credit Saison’s personal loan application. This application is available on the Play Store and was previously known as Privo. This application is RBI registered, so it is completely trusted.

Loan Details

- Loan Amount – RS 20,000 to 5 lakhs

- Rate Of Interest – 10% to 40%

- Processing Fees – 1% to 3% of loan amount

- Repayment Tenure – 3 to 60 Months

- Forecloser charges – Nil

Eligibility And Required Documents

- Above 21 years old

- Salaried and self-employed individuals can apply

- A CIBIL score above 700 with a good repayment history

- Only PAN and Aadhaar cards are required to apply for the loan

Moneyview Loans And Invesment ( APPLY HERE )

This application is very popular for providing loans to salaried and self-employed individuals in India. It is also directly registered with the RBI and is genuine.

Loan Details

- Loan Amount – RS 5,000 to 10 Lakhs

- Annual percentage rate – 10 to 39% per annum

- Processing fees – 2% to 5%

- Repayment Tenures – 3 to 60months

Eligibility And Required Documents:

- Must be above 21 years old

- Salaried and self-employed individuals can apply

- Minimum income of RS 13,500

- Credit score must be at least 650

HDB OnTheGo: Easy Loan Online ( APPLY HERE )

This application does not mention complete loan details, but we recently applied and received a personal loan through the HDB OnTheGo application. All details are explained on our genuine partner’s YouTube site. If you need more information, please check there.

Loan Details

- Loan Amount Upto 20 lakhs

- Repayment tenure 12 to 84 Months

Eligiblity And Required Documents

- Salaried and self-employed individuals can apply

- With best cibil score and credit history

- Required only PAN And Aadhar Card

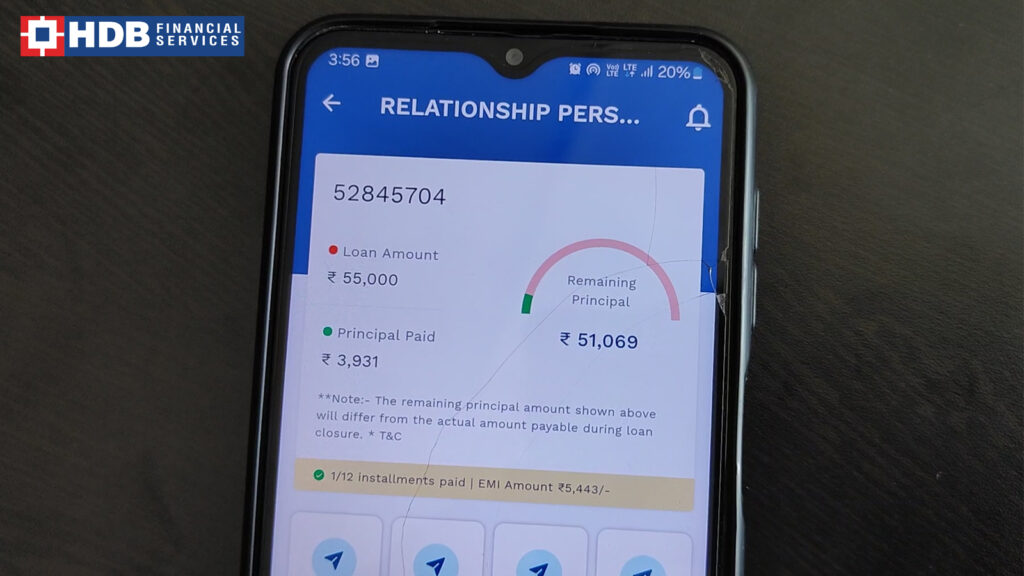

Our Realtime Loan Details

- Loan amount – 55,000

- Interest rate – Nearly 33% per annum

- Repayment tenure – 12 months

- Processing fees – 1,947

- Acko insurance amount – 2,599

- Stamp duty – 200

- Monthly EMI – 5,499

- Total repayment amount – 65,316

This application mentions many eligibility criteria, but we applied using only our PAN and Aadhaar cards. We also presented my retail business but did not provide any income or business proof. If you have a good credit profile, you have a greater chance of getting a personal loan.

Disclaimer

We are not responsible for anything related to this loan application, so please take your own risk before applying for a loan.

Thank you.

Dhivakar

2000